The Financial Services industry is changing fast and the sector is awash with FinTech start-ups and SaaS companies offering new technology and innovative solutions. Businesses within the industry need to evolve to thrive in this digital landscape. The traditional marketing and lead generation methods are still important, but strategic SEO for Financial Services is key to online growth.

In this blog, we look at the vital role that SEO plays in Financial Services marketing.

Focus on creating high-quality content

Producing quality content is paramount. The Financial Services industry demands security, trust and expertise, as businesses and customers alike want peace of mind when it comes to products and services that deal with people’s money. Your brand’s reputation is key. Aim to become an authority on the subjects at the core of your business and a thought leader within the Finance industry.

Creating high-quality content helps you to win the trust of leads and prospects and earn brownie points from Google and other search engines, which rank informative, authoritative and accurate online content highly. In fact, Google's 2022 "helpful content update" placed particular emphasis on helpful content that is created for humans first, with signals that identify unhelpful content that does not align with search terms and intent, greatly impacting how well a page ranks.

The latest helpful content algorithm updates in 2023 have further reinforced the system's ability to de-rank content deemed unhelpful to searchers' intents, specifically existing third-party content hosted on both main and subdomains. Simultaneously, as the use of AI for content creation gains in popularity, AI-generated content now ranks more favourably on Google than before.

Google has dedicated content evaluators, who use search quality rating guidelines to help them rank the quality of pages appearing on search results pages. The evaluators also establish how well Google’s algorithm is filtering out low-quality content around particular subjects.

Key factors Google content evaluators look at

The most important factors that Google considers when evaluating pages are:

-

Page purpose

-

Main content quality

-

Amount of content

When it comes to quality of content, marketers should consider E-E-A-T, which stands for experience, expertise, authoritativeness and trustworthiness. It’s important to produce content which reflects these attributes. Those rating the content look at:

-

Who is the content author and how trustworthy are they?

- Does the author have relevant experience to back up their claims?

-

What are the author’s qualifications and what expertise do they have?

-

How often is the information on the pages updated and maintained?

It’s important to be aware that Google puts a special emphasis on the quality of “YMYL pages” when considering SEO for Financial Services marketing.

What does YMYL stand for?

YMYL stands for “Your Money Your Life” pages. Essentially, pages that contain content that can influence an individual’s quality of life, potentially impacting their happiness, health and wealth. Here are examples of the types of pages that come under the umbrella of YMYL:

-

Financial information pages: providing users with information about financial themes like investments, insurance, taxes, pensions, property buying and savings, etc.

-

Financial transaction/eCommerce pages: enabling users to make purchases, pay bills and transfer money online.

-

Legal information pages: providing readers with legal information and advice, covering topics like marriage, divorce, child custody, worker rights, creating a will, etc.

-

Medical information pages: giving people information or advice on health, nutrition, medication/drugs, medical conditions and symptoms, mental health, etc.

-

Other YMYL pages: lifestyle-related web pages covering topics like safety, security, well-being and mindfulness.

Website pages which come under the categorisation of YMYL are scrutinised more than any other pages, so you need to ensure that your content is of the highest quality, relevance and accuracy. And be specific, so that you can give people clear and authoritative answers to questions posed in your content or provide information which offers real value to your target audience.

Relevance is key in content marketing

We’ve talked about creating high-quality content which aligns with the key considerations of search engine evaluators and algorithms, however, your first priority should be the relevance of your content to your audience.

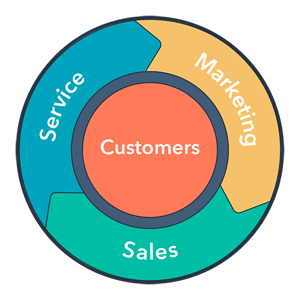

This customer-centric approach is at the heart of the inbound marketing methodology. Aligning business goals with customer needs helps to engage your audience and demonstrates how your company has the solutions to their needs, challenges and pain points.

When planning your marketing content and campaigns, be it blogs, guides or case studies, you should first research the things that your customers and prospects are most interested in, what drives their buying decisions and how your services can help them. This makes crafting content so much easier and helps to keep content relevant, valuable and compelling. You can learn more about inbound marketing strategy in our Ultimate Guide to Inbound Marketing for FinTech and FSI Companies.

Become a thought leader when using SEO for Financial Services marketing

When approaching SEO for Financial Services marketing, relevance, thought leadership and helpful content are all crucial. If you’re producing content that’s relevant to your personas’ interests, from a solution perspective, it helps you to attract them to your website pages. LinkedIn-Edelman's 2021 B2B Thought Leadership Impact Study revealed that 64% of management-level professionals say thought leadership is a more trustworthy basis for assessing a vendor’s capabilities and competency than marketing materials and product sheets.

Carry out keyword research into the subject areas you’re creating content around and incorporate keyword phrases that are most relevant and which receive the most search volume. Again, think specific. This will help your marketing content and pages to rank, as it’s difficult to rank for broad keywords.

Try to keep your content easy to understand. Using your audience’s language makes your content more accessible. It will resonate more with the reader. This is highly important in SEO for Financial Services companies, as the Finance and Banking sectors tend to overuse complex terminology and jargon, which can put readers off.

Using video content can solve this, too. Videos can break down complex ideas into bite-sized chunks and help people retain messages more effectively than they can from text-based content. It will help to establish your brand as a trusted source of information and an industry thought leader.

Optimise your content and help prospects find your website

Use language, keywords phrases and questions that your target audience is likely to be searching for. You can make assumptions based on your experience, but it’s also vital to carry out proper SEO ranking and keyword volume/difficulty research. This ensures that your content and tags incorporate the keywords and queries that people are actively using to search for solutions to their challenges.

Other technical SEO considerations for optimising your online content include:

-

The accuracy of your content

-

Meta tags/description

-

Relevant and accurate links

-

Anchor text

-

Image tags

-

HTML page content structuring (H1s, H2s, etc.)

Then there are some outreach and social proof considerations which help to boost your content’s reach and impact. These include:

-

Guest blogging

-

Co-branded content collaboration

-

Backlinks

-

Quotes and testimonials

-

Case studies

-

Reviews

-

Badges/certifications

It’s important to have an outreach strategy for your content marketing plan, as gaining backlinks for your blogs and key website pages improves your traffic, ranking and domain authority. It also helps build trust and social proof. In fact, according to Ahrefs, 43.7% of the top-ranking pages on Google contain reciprocal links.

As well as reaching out to respected sites and industry through-leaders when seeking backlinks, we recommend looking at content-sharing opportunities, such as guest blogs, content collaboration and sharing your existing content to social media groups and websites like Medium, Reddit and Quora. These outreach approaches take time to implement but they are big factors in successful SEO strategies for Financial Services marketing.

Quoting sources and back-linking

When quoting sources and linking out to external websites, ensure destination pages are accurate and relevant. It’s important to cite trustworthy information, as it will impact your own website’s reputation and ranking. Use tools like Screaming Frog to monitor your website for 404s, as error pages are penalised by Google. If an external site removes a web page that you’re linking out to, this will generate an error page on your own website.

Monitor your content’s performance and utilise the SEO tools available

Creating informative and evergreen content for your target audience is important, but you must regularly monitor your content's performance to ensure it remains relevant, accurate and optimised. We recommend carrying out regular content audits.

Also, there is a range of great SEO tools available to businesses to improve online content performance. Here are some of the best SEO tools we recommend:

- Moz – offers SEO and analytics tools to improve link building, content marketing and search ranking.

-

SEMrush – a powerful suite of SEO tools to monitor keyword performance, provide competitor benchmarking and gap analysis, plus much more.

- BuzzSumo – identifies keyword and content trends, to steer your content marketing strategy.

- Screaming Frog – crawls and tracks websites to provide analysis on SEO performance and technical issues.

- Hotjar – a customer journey monitoring tool to help improve SEO and UX, using heatmap technology and other smart tracking capabilities.

Although companies should not become too obsessed with their competitors’ marketing activity, as it’s important to maintain a unique brand identity and demonstrate differentiators, it’s useful to see what they’re doing well and what they’re not. This will help your business to identify opportunities to improve and get an edge over similar Financial Services companies in your market.

Don’t forget to respond to content engagement. If your blog enables users to leave comments, you should monitor and regulate this, responding to any valid comments and questions. Failure to acknowledge them sends the wrong signals to users and to Google's content evaluators.

This applies to social media engagement, too. Responding quickly to post engagement is reflected on social profiles, whilst useful responses to comments on articles demonstrate an interest in your audience’s needs.

Be aware of the changing face of SEO for Financial Services

New digital technology and social media trends influence the search patterns and buying decisions of consumers and businesses. Marketers must stay ahead of the curve and keep up with the changing face of SEO marketing.

Video marketing, AI assistants and voice search have changed SEO priorities for marketers in recent years. It’s important to consider the different languages people use when searching for business solutions via different formats and devices.

The impact of AI on SEO

Generative AI has had a notable impact on just about every part of our digital lives, and SEO is no exception. With Google joining the AI race off the back of OpenAI's success with ChatGPT, we are starting to see the dawn of a new era in Search - one characterised by AI-powered search results alongside traditional search results in SERPs.

In light of the introduction of Bard and Google SGE, SEO tactics need to be adapted to account for changes to the search experience; both in terms of how AI delivers search results and how users interact with AI when conducting searches on Google. Best practices around title tag and image optimisation are particularly key.

To find out more about Google SGE, how it works, and the influence it has on SEO, as well as how you can prepare for these changes in Search, read our Google SGE blog.

Content pillars - what are they and how do they work?

Another big recent change in approach to SEO, especially for inbound marketing and content creation, is to build “content pillars” and “topic clusters”.

Content pillars are hubs of content created around a particular subject area that your organisation wants to be known as a thought leader in, and which reflect a key business offering. Building pillar pages (or “skyscraper content”) around these subject areas helps to drive traffic to your website.

Creating lots of great content on the subtopics within the subject area form topic clusters, which feed into the pillar page. The pillar pages should be long-form pieces of content, rich in insights and information related to the subject area. And they should link out to the more specific subtopics and use CTAs to drive readers to content offers and money pages.

Finally, the quality of customer service delivered by companies has emerged as a key ranking factor, so we recommend embarking on a project to get your Customer Service, Marketing and Sales teams working together more efficiently. Online reputation is key for businesses in the Financial Services industry and this should now be a key consideration when looking to improve your Financial Services company's SEO.

For more on the latest trends and approaches, check out our recent blog on the 10 Top SEO Trends for FinTech Marketers.

Summary: Embracing SEO for Financial Services marketing

An effective SEO strategy is crucial for making the most of your marketing content’s potential, driving organic growth online and building customer trust. We’ve outlined the fundamentals of an effective approach to SEO for Financial Services companies, now it’s time to get to work! If you want to maximise your online presence by refining and enhancing your SEO strategy, then get our handy Essential SEO Strategies for Financial Services Guide for more SEO tips and insights.

Alternatively, if you'd like to learn more about what specialised SEO services Inbound FinTech offers businesses, check out our SEO services page, or get in contact with our experts.

NOTE: This blog was first published in February 2019 but has been updated in 2023 to reflect industry changes and recent SEO updates and trends.

Inbound FinTech (IFT) is an award-winning digital growth agency and elite HubSpot partner. We specialise in inbound marketing, SEO and PPC strategy, helping Financial Services companies to improve their marketing performance. Based in London, UK, in the heart of the financial district, our experienced team of marketing specialists can transform your lead generation process with proven inbound marketing strategies. Get in touch with IFT to discuss your company's SEO needs.

%20(3).png)

.png)

-1.png)