Mobile payment is a trend on the rise. In fact, roughly 50 percent of millennials in the U.S. have now used a mobile wallet. The reason why mobile payments are growing in popularity is because they are swift, convenient, and more seamless than traditional cash or credit card payments.

Samsung Pay and Apple Pay are two of the most popular mobile payment methods. Over 56 percent of people who use these technologies make at least one mobile payment per week. However, despite the growing use of mobile payments, there are still some marketing problems regarding this technology. Here are some of the top 5 FAQs about mobile payment marketing problems.

How do we address concerns about security?

Negative perceptions about security are one of the biggest challenges facing mobile payment providers. This is especially true considering the fact that of 900 cyber security professionals in a survey, 47 percent said that mobile payments are not completely secure. Seemingly constant high profile data breaches and hacks do not help the situation.

To solve this challenge, mobile payment companies need to advertise the security features of their system, and also, the fact that if a breach does occur, the money will be reimbursed to the mobile wallet holder. Otherwise, security is likely to continue to be a large pain point for many mobile payment providers.

How do we display advantages over credit cards and cash?

Cash and credit cards are the main competitors for mobile payments. This means that if mobile payments are going to thrive, that they need to have advantages over cash. There are several advantages of mobile payments over cash and credit cards. First, they do not require you to go to an ATM. Second, they are faster. Third, they can save users on credit card fees. Finally, fourth, they can have loyalty programs built into them. All of these advantages should be highlighted through marketing efforts to demonstrate the competitive advantages of mobile payments.

How do we get people to change their old habits?

It takes roughly 66 days for a new habit to form. Considering the fact that most people are already wired to make payments through cash and credit cards, getting them to form the new habit of making mobile payments can be difficult. There are a number of ways that you can use marketing to help solve this problem.

First, you can reinforce the idea that trying new things is fun. This can get people excited about trying mobile payments. Next, you need to have consistent marketing content that helps to drive home the concept of mobile payments over the long-term. This is to help to remind people to keep trying mobile payments until they establish the habit. You don’t want them to forget about your payment system before they do. You can also sponsor events. This way, people will come to associate your brand with new and exciting things.

How do we address availability problems?

Only roughly 35 percent of U.S. merchants accept Apple Pay. This number can be even lower for lesser known mobile may companies. So, trying to get people to maintain their use of mobile pay when it is not available in so many stores can be a major problem for mobile payment marketers.

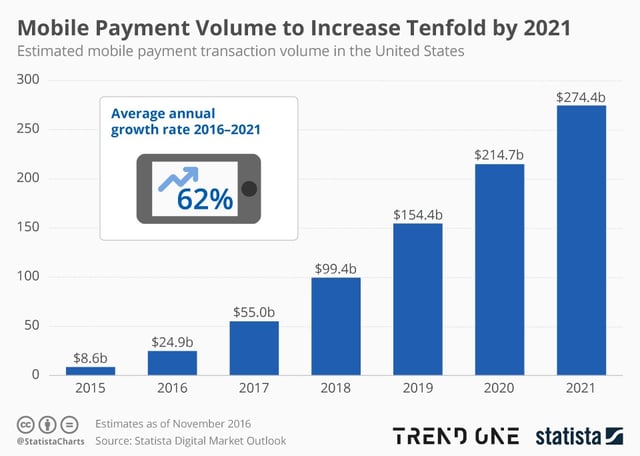

One way to deal with this is to reference statistics of how fast the mobile payment industry is growing. You can show stats that demonstrate the growth of the industry. For example, infographics like this can be very helpful.

This can show both merchants and consumers alike that mobile payment is a trend that is not disappearing any time soon, and is only growing in strength. This can lead to increased adoption.

How do we choose between traditional/outbound marketing and inbound marketing?

Traditional marketing involves using outbound strategies such as billboards, television ads, radio ads, PPC, brochures, newspaper ads, etc. Outbound marketing also includes digital efforts like PPC (pay-per-click) etc. Inbound marketing includes using techniques such as SEO, blogs, articles, Youtube videos, social media accounts, emails, and other similar methods.

If you have to only select one advertising strategy to use, then you should use inbound marketing. This is because per dollar, content marketing produces an average of 3 times as many leads, compared to outbound, or traditional marketing. Also, 68 percent of consumers are likely to read content from a brand that they are interested in. Both of these stats are highly significant, and demonstrate why you should prioritize inbound marketing.

Inbound FinTech is an award-winning digital growth agency and Elite-Tiered HubSpot Partner. We help FinTech businesses significantly improve their marketing performance.

We can transform your lead generation process, boost website traffic and help you to attract your ideal customers and generate quality leads through proven inbound marketing tactics and strategies.

%20(3).png)

.png)

-1.png)