FinTech and Financial Services businesses have long relied on referrals, trade events and more traditional sources of lead generation. But as fast-advancing technology continues to change buying behaviours and the events space evolves, Marketing teams need to adapt their approach and look at an array of digital channels and tactics for driving high-quality leads. We outline 12 top FinTech lead generation trends and strategies for building a healthy pipeline.

NOTE: This blog was first published in November 2020 but has been updated in January 2024 to reflect industry changes and recent updates and trends.

Why businesses must modernise their lead generation strategies

The growing adoption of digital solutions has accelerated the need for businesses to modernise their lead generation strategies. For too long the Financial Services industry has been complacent and over-reliant on physical events, old-school business development tactics and outdated CMS and CRM systems. Many companies are grappling with critically outdated infrastructure and need to deal with the impact of these less-than-optimal systems.

Businesses today face critical choices when investing in much-needed system upgrades. However, the need for modernisation doesn't stop at technology alone. Re-evaluating your approach to FinTech lead generation is equally imperative. Scroll down to discover the latest trends in FinTech lead generation that can provide valuable insights for your business.

FinTech lead generation trends to boost your pipeline

Here are our 12 top lead generation trends for FinTech and Financial Services companies, with strategic tips on how to revamp your lead gen strategies.

1. Rethinking the event-based approach to lead generation for FinTech

With changing consumer preferences and habits, businesses have had to rethink their lead generation strategies and redistribute their budgets accordingly. While some big FinTech and Financial Services events continue to flourish and see steady attendance, many are now either hybrid events or online-only.

As people actively seek out online platforms for industry engagement, you should embrace the opportunities of hosting and attending online events, virtual conferences and webinars as a source of lead generation for FinTech. Traditional events are costly, time-consuming and don’t always provide good value for money. Unless you’ve got deep pockets or you’re a well-known brand, hosting in-person events can be a risk.

Webinars are a great source of FinTech lead generation, provide good ROI and can be quick and easy to organise, especially once you’ve developed an effective process for maximising their value. Webinars can help grow your digital presence and showcase your expertise and products, whilst providing an easy way to move leads into your nurturing processes and sales funnel.

2. Leverage the power of AI

AI is revolutionising the Financial Services landscape, reshaping how businesses operate and serve clients. The influence of AI in the sector is seen across several functions, such as:

-

Customer experience enhancement

-

Compliance and regulatory reporting

-

Risk management and fraud detection

-

Algorithmic trading and investment management

There are many ways teams can adapt to this transformative wave, including embracing automation, better understanding how data-driven insights provided by AI tools are crucial for making informed decisions and prioritising continuous learning to stay updated on the latest advancements in AI.

Similarly, there are several AI-powered tools available that can enhance marketing tactics and approaches. These include predictive analytics platforms, chatbots and virtual assistants, lead scoring models, programmatic advertising platforms, AI-powered content recommendation engines and Customer Relationship Management (CRM) systems with AI integration.

3. Utilising video content

Video is now a key part of a marketer’s toolkit, especially for FinTech and product-based companies. There are lots of great opportunities to leverage the power of video to showcase the value of your products and services.

Here are just a few ways you can utilise video for FinTech lead generation:

- Explainer videos

- Tutorials

- How-to videos

- Educational content

- Regular thought-leadership series

- Webinar recordings

- Case studies/testimonials

The opportunities are endless and videos are extremely powerful for driving messages home.

Research found that video content can increase your organic traffic by 157%, boost your conversion rate by 80%, and improve your brand recall by 95%. (Source: Zight)

4. Thought leadership

Becoming a thought leader in your niche is crucial these days, especially for high-value products or SaaS. Establishing your brand as a thought leader can go a long way in helping you gain customer trust, build authority and aid decision-making.

So, how do you go about this? Leverage the experts within your business and collaborate with peers, partners and prominent industry figures. Publishing insightful articles or increasing your brand presence through guest blogs or industry reports are effective ways to earn the trust of your target audience.

Social listening is also a good source of lead generation for FinTech brands. Be active on different social channels and become part of key industry conversations.

Check out our video with HubSpot on the importance of thought leadership in Financial Services.

5. Trust factors

Trust is such an important commodity in the Financial Services industry. So, adding trust factors to your website and marketing content helps to move leads down the funnel.

We mentioned how thought leadership can build trust. Here are some other trust factors:

- Testimonial quotes and video testimonials

- Case studies and use cases

- Customer reviews

- Free trials or samples

- Interactive content, such as calculators

If you’re considering purchasing financial products and services, trust is a key part of the decision-making process.

6. Collecting user data

Effective FinTech lead generation starts with your data. Make use of your CRM and carry out detailed research into your users to better understand your audience’s needs. Is your CRM giving you the right level of user data and insights? Or is it holding you back? Speak to our team to get an assessment of your current CRM.

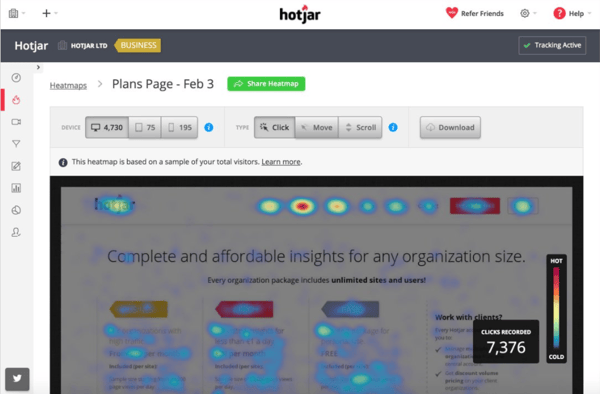

Also, consider using marketing platforms like Hotjar, Semrush, Moz and BuzzSumo to generate deeper insights into search patterns, industry trends and user behaviours.

7. Using your data to steer FinTech lead generation campaigns

Use the data and insights you gain from your research, CRM and analytics platforms to build lead generation campaigns and optimise your content, landing pages, CTAs, email workflows, etc. Find out more about how the right CRM setup for your business can help you gain valuable data insights and drive leads in our on-demand CRM webinar.

Your user insights are one of the most important tools at your disposal. High-performing websites and effective FinTech lead generation strategies are focused on addressing and solving user needs. These insights will also help you get the most ROI from your PPC campaigns and paid social activity.

8. Experimenting and optimising content

Enjoying long-term marketing success and maintaining a healthy lead pipeline relies on having a continuous improvement mindset, rather than a “set-it-and-forget-it” approach. Continue to test and optimise content and campaigns to ensure you maximise your chances of attracting, engaging and converting leads.

9. Segmentation and personalisation

Personalising content and communications is crucial for FinTech lead generation and nurturing. Whether it’s segmenting your database for email marketing campaigns and workflows or adding personalisation to subject lines and landing pages, relevance triggers better engagement. 90% of marketers say personalisation makes businesses more profitable. (Source: Adam Connell)

.png?width=594&height=263&name=lead-generation-blog-personalisation-statistic-2023%20(2).png)

The aim is to offer the right information to the right people, at the right time. Segmentation and personalisation help to shorten the sales cycle and ease decision-making. You can use smart content on your website to show different content to different visitors, depending on various criteria, such as persona type, geo, lifecycle stage, actions taken, etc.

10. Stepping up your SEO

Driving leads to your website organically is the most cost-effective FinTech lead generation method. Organic leads that find your key content are more likely to be high quality (if your content is optimised/user-focused) as they’re searching for solutions which your content should address.

Monitor your SEO performance and keyword ranking regularly, carry out keyword gap analysis and map your content to target key phrases. Your personas (ideal customers) should find your key content and website pages through the most relevant online or voice searches.

Creating content pillars and developing topic clusters that feed into these pillars is an increasingly popular tactic for driving organic leads. Find out more in our blog on the importance of SEO in Financial Services.

11. LinkedIn Ads and account-based marketing (ABM)

Account-based marketing is a fast-growing approach to lead generation for FinTech and Financial Services. It’s primarily a B2B lead generation approach that aims to focus campaigns around target accounts to attract and nurture key decision-makers within these organisations.

66% of marketers say ABM significantly improves marketing and sales alignment. (Source: Forbes)

ABM involves a deeper level of lead nurturing and requires your Sales team to create custom approaches. Learn more about account-based marketing in HubSpot’s Ultimate Guide to ABM or in our Embracing Account-Based Marketing in Financial Services blog.

LinkedIn is a powerful platform for lead gen, especially in the B2B space, offering a range of paid advertising and lead generation tools for marketers to leverage to target and engage their key personas. We use LinkedIn Ads in combination with HubSpot automation workflows to help FinTech brands operate cost-effective paid campaigns.

If you operate in the B2B space, get our B2B Lead Generation Case Study, which features lead generation campaigns that saw us named as a finalist in the LinkedIn Marketing Awards.

12. Get your nurturing game tight

Attracting bags of new leads is great, but that’s only part of the FinTech lead generation story. You need to nurture leads and move them towards buying decisions. Automation and quality content play a big role in successful lead nurturing and save your Sales team a lot of time and effort.

Devise a nurturing strategy covering the different entrance points to your database and pipeline, incorporating your most relevant content and utilising automation workflows, lead scoring/qualification, personalisation, segmentation and retargeting.

Summary: Modernise your FinTech lead generation strategies

We hope you found this blog post useful. These modern trends for successful lead generation for FinTech companies will breathe new life into it and help you develop a healthy lead pipeline.

Do you think your FinTech lead generation strategy could benefit from an overhaul? For additional insights to modernise your methods, why not check out our Proven Lead Generation Strategies Guide for Financial Services? This handy guide offers a wealth of tips, insights and actionable strategies to elevate your approach. Download the free guide!

We also offer a range of lead generation services for FinTech and Financial Services companies. If you’d like to discuss our services, why not speak to our expert team today?

Inbound FinTech is an award-winning digital growth agency and elite HubSpot partner agency. We develop effective FinTech lead generation strategies for businesses and drive high-quality leads through proven inbound marketing methods and a growth-driven approach. We can help you to transform your lead pipeline and modernise your methods. Get in touch with our lead gen experts.

%20(3).png)

.png)

-1.png)